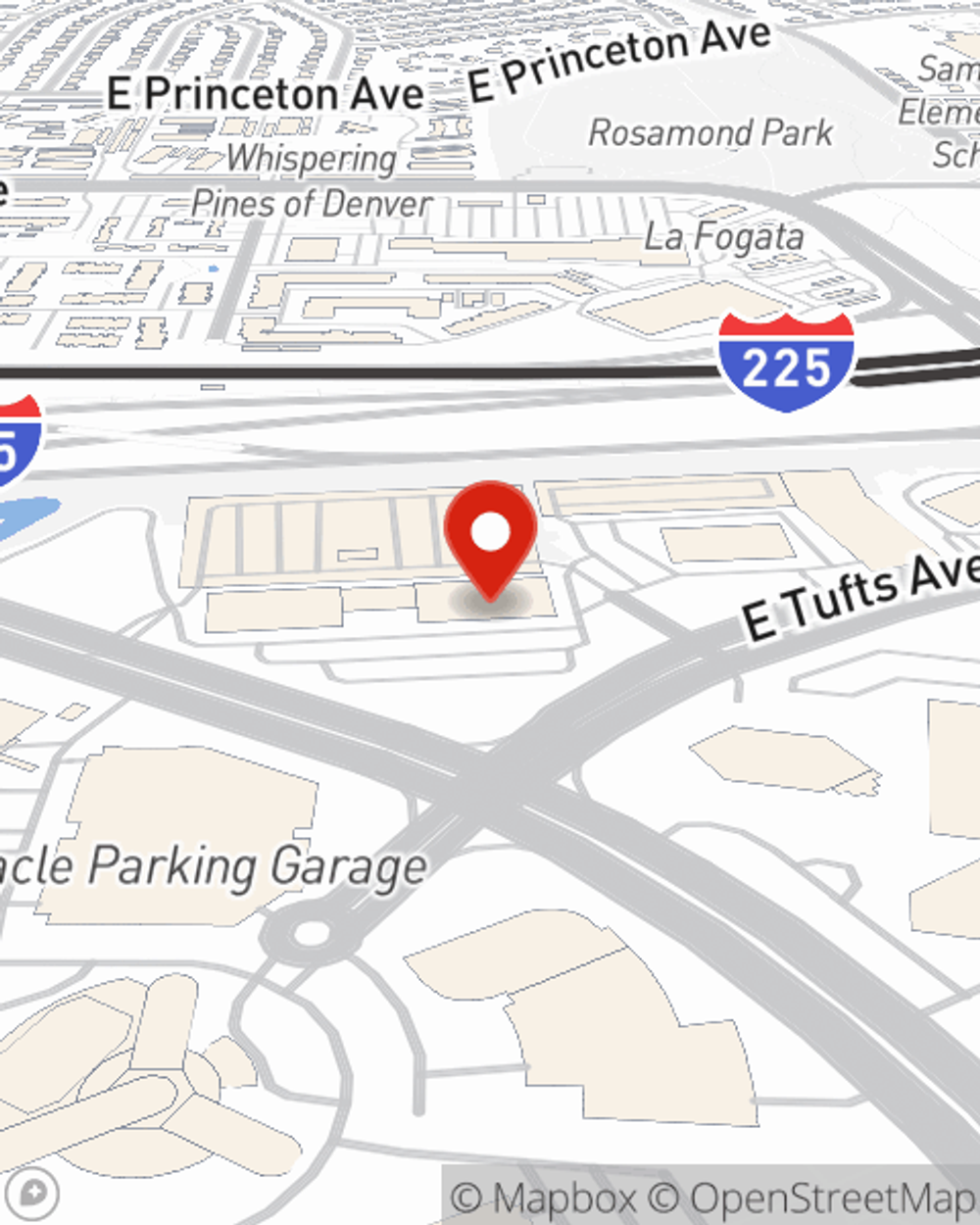

Business Insurance in and around Denver

Searching for protection for your business? Search no further than State Farm agent Nese Sahin!

This small business insurance is not risky

- Greenwood Village

- Denver Tech Center

- DTC

- Parker

- Aurora

- Lone Tree

- Arapahoe

- Glendale

- Cherry Creek

- Lowry

- Castle Rock

- Castle Pine

- Littleton

- Lakewood

- Broomfield

- Golden

- Arvada

- Boulder

- Brighton

- Nortglennn

- Superior

- Englewood

- Longmont

- Thornton

Cost Effective Insurance For Your Business.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like extra liability coverage, worker's compensation for your employees and a surety or fidelity bond, you can take a deep breath knowing that your small business is properly protected.

Searching for protection for your business? Search no further than State Farm agent Nese Sahin!

This small business insurance is not risky

Get Down To Business With State Farm

Whether you own a veterinarian, a home cleaning service or an arts and crafts store, State Farm is here to help. Aside from fantastic service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by calling or emailing agent Nese Sahin's team to explore your options.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Nese Sahin

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.